Nimo digital lending: Platform implementation partner

Create Seamless Digital Lending for your Customers

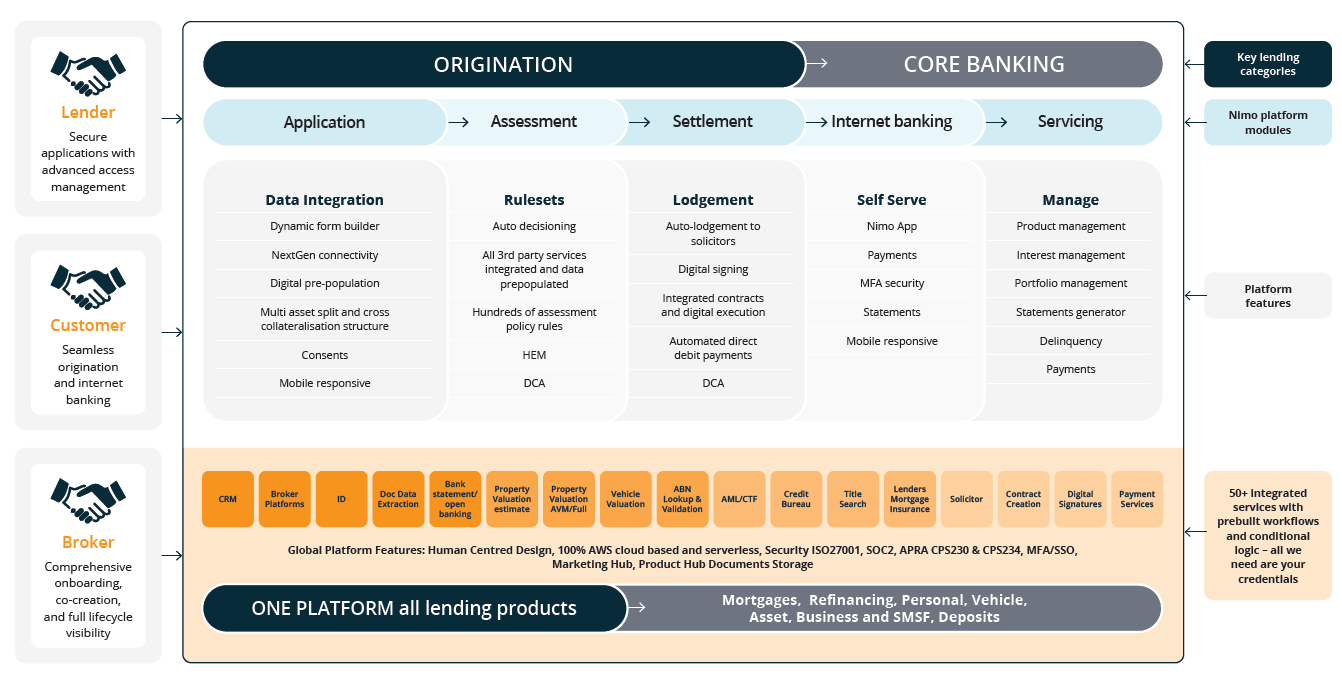

Nimo Industries is an Australian owned award-winning SaaS provider that revolutionises lending origination and credit management designed for Banks, Lenders, Credit Providers (including trade credit) and Brokers.

A turnkey solution integrated with real-time digital services, Nimo’s powerful end-to-end lending platform streamlines the entire process. From loan origination, underwriting, same-day loan decisioning and settlement, to management of the transaction and core banking and servicing, Nimo enhances efficiency and customer experience.

Sophisticated. Simple. Seamless. Configure what you need, when you need it

With all the functionality you need from loan origination to management already built in, you can pick and choose what suits your needs, when you need it. Start with the basics and scale up as required, with all digital assets easily customised to reflect your brand.

Whether you're gathering customer data online or automating an end-to-end lending process, Nimo is designed to make the entire experience remarkably simple.

Build your online banking capability in stages or all at once

How 4impact and Nimo empower financial institutions

4impact and Nimo work together to streamline and modernise your lending processes

4impact's focus on data enablement underpins their approach to digital transformation, ensuring that with the adoption of Nimo, your institution will be adopting a lending solution that's scalable, adaptable, and tailored to your customer's unique needs.

Connect all your channels and customers with Nimo,

either all at once or iteratively into a single platform that works from day 1.

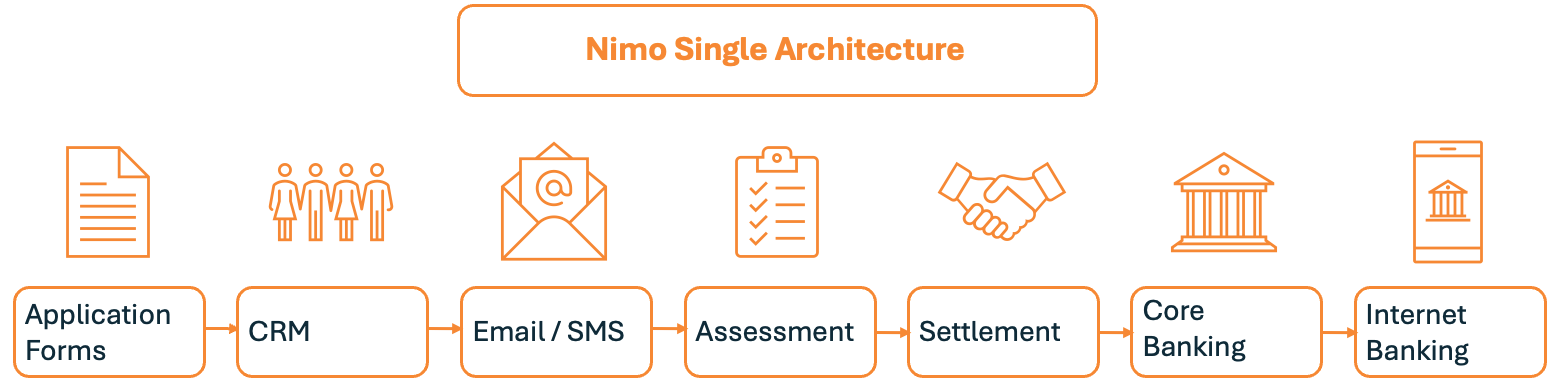

Nimo's single architecture makes digital lending simple

- Single orchestration layer where external data is migrated into a single trusted data model and reused across services.

- All lifecycle communications are sent and actioned within a single platform.

- Data provided by a Nimo broker is trusted, verified and reused by a Nimo lender.

- Enables easy integration with both proprietary and LIXI data model connections.

Nimo Benefits

Nimo includes comprehensive integrated, pre-built and configurable workflows and decision rules that homogenise data. This means that all parties to an application (Lender, Customer, Broker) can co-create on top of a single data model, enabling full data availability for ‘right first time’ applications with process automation and improved time to decision.

Feature rich with all your lending needs in the one platform, powered by advanced architecture, Nimo offers a range of market-leading benefits to you.