Banking and Financial services change and transition experts.

We're driven to help banks, mutuals and financial services to digitally evolve and transition.

Banking and Financial services used to be built to last.

Today, they need to be built to change, they need to be composable.

At 4impact, we understand the need for proven digital solutions and services.

Whether you are a Bank or a Lender, traditional core systems deliver the same business barriers – poor integration, limited data access and time and cost barriers to change. There is no shortage of skills or tech, there is however a lack of clarity (and apprehension) on where and how to start.

We offer change options in manageable bites that deliver value at every step.

Our primary focus is on Data access, Data management, Data streaming, Governance and Automated reporting.

ROI-driven investment and effective delivery are about envisioning what’s possible and then harmonising people, process and technology. 4impact focuses on leading from the front to bring these elements together.

Australian Mutual Banks share some common problems.

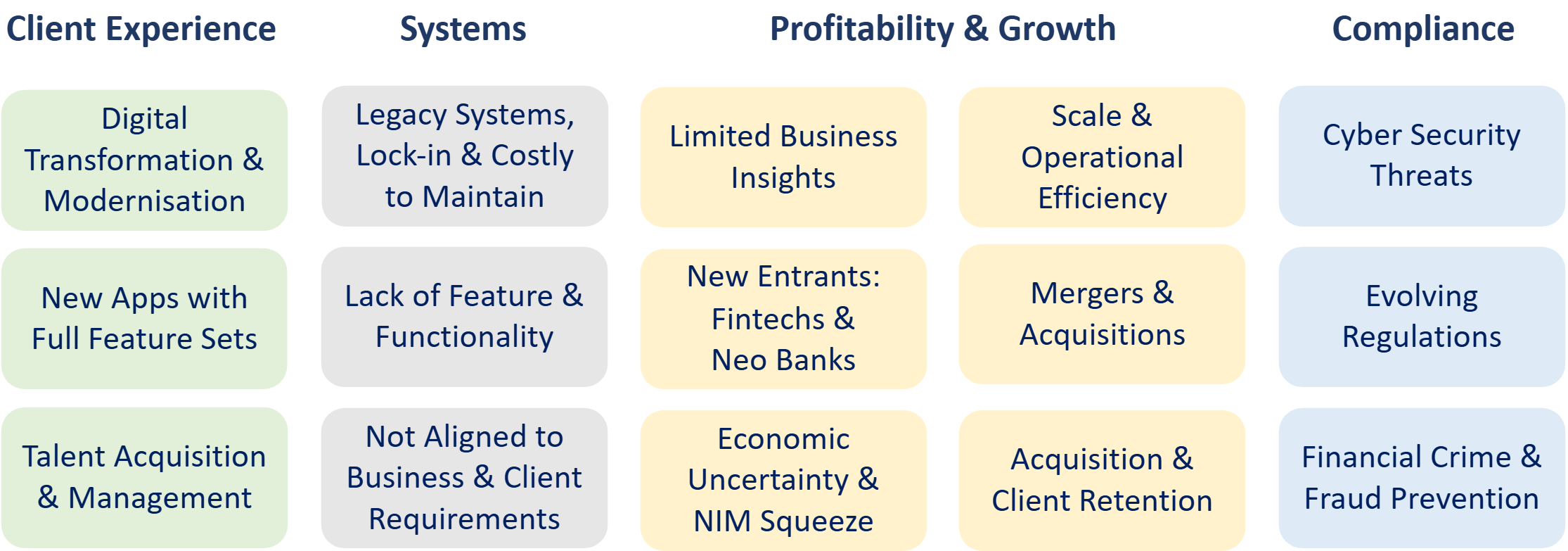

There are several key challenge 'themes' that have consistently arisen throughout our conversations and engagements in Australian banking.

- Client Experience: Many are concerned that their current client experience is limited, with any improvements being costly and time-consuming to implement.

- Systems: Their internal systems are outdated (legacy), disconnected, and labour-intensive, making maintenance costly and hindering business growth.

- Profitability & Growth: Outdated IT systems are restricting their ability to modernise their operation and drive profitability.

- Compliance: Staying up to date with regulatory changes is slow and expensive, as limited access to data often requires manual processes to gather the necessary information.

Services and solutions to help unleash your inner digital bank.

Banking Consulting Services

Consulting to enhance customer experience, optimise systems, streamline operations, drive growth through strategy and innovation.

- Digital Transformation & Modernisation

Tailored approaches to enhance your bank’s digital strategy, improve online platforms, mobile apps, and customer experience. - Best-of-Breed System Evaluation

Recommendations for optimal banking and financial systems to enhance flexibility and support growth. - Core Banking System Assessment

Whether upgrading legacy systems or merging banks, we align core systems with immediate and future goals. - Legacy System Gap Analysis

When transitioning to new systems, the identification of operational gaps ensures minimal disruption. - System Architecture & Integration

System assessments to define an improved future state, and the creation of seamless integration roadmaps. - Reporting Services

Reporting across disparate systems is complex and costly. Streamlined solutions simplify data management and reduce expenses. - Compliance Services

Through our partners, we are able to offer comprehensive compliance solutions.

Banking Technology Services

Specialised services and tools to streamline data management and its accessibility, to enhance decision-making and operations.

- Data Migration:

Our data migration services ensure a smooth transition of data from legacy systems to modern platforms, minimising disruption and ensuring data accuracy throughout the process. - Data Integration

Leveraging our extensive experience, we handle data extraction from source systems and inject it into target systems, ensuring data integrity and accessibility for improved insights and streamlined operations. - Data Warehouse

Design and implement of scalable data warehouses provide secure, organised storage, enhancing reporting and enabling real-time analytics for informed decision-making. - Event Streaming

Real-time event streaming solutions allow banks to process and analyse data instantly, driving faster, data-driven decisions and improving operational efficiency. - Dashboard and Report Generation

The creation of custom dashboards and reports provide operational, customer, and regulatory insights, enabling informed decisions and compliance.

Banking Business Solutions

Business solutions designed to resolve common pain points and operational friction based on first-hand, trusted banking sector insights.

- Loan Origination System (LOS):

Legacy-tied LOS systems slow approvals and harm customer experience. Decoupling from the core enables modern, automated LOS solutions for faster, more efficient loan processing. - Core Banking System:

Mergers, acquisitions, and digitalisation are driving core system upgrades. With 20+ years of experience, we strategically guide banks through upgrades and migrations. - AML/CTF/KYC:

Legacy core banking systems often result in inefficient compliance processes. Moving these functions from legacy systems enables the implementation of modern applications for improved efficiency. - Financial & Regulatory Reporting:

Legacy systems hinder reporting speed and accuracy. Through the implementation of modern tools, efficiency is enhanced, costs are reduced, and manual effort is minimised. - Data Enablement:

Legacy systems limit data access and integration. Our solutions help mutual banks establish a ‘golden record’ and regain data control. - Customer Communications:

Empowering banks to deliver personalised, interactive messaging through customers' preferred channels, driving engagement and enhancing operational efficiency at scale.

Put simply, we get customer-owned banking.

Let's start a conversation about unleashing your inner digital bank.

Head Office:

1300 112 100

(Int +617 3177 1400)

Follow 4impact via LinkedIn